NEW YORK - Now that the U.S. war with Iraq is over, President Bush has sharpened his focus on the economy, particularly his push for a bigger tax cut than the one recently passed by the Senate. Bush claims the bigger cut will lead to more job growth, but economists aren't so certain.

Though Bush is unlikely to get the $726 billion tax cut he originally wanted, he can at least rest assured that the debate over whether to cut taxes is history. The only questions now are which taxes will be cut and how big the cuts will be.

Bush makes the argument seem like a simple one -- if a $350 billion tax cut will create jobs in an economy that desperately needs them -- about 2.6 million people have lost their jobs since March 2001, when a recession began -- it stands to reason that $550 billion would create even more jobs.

"Some in Congress say the plan is too big. Well, it seems like to me they might have some explaining to do," Bush said in a speech Thursday at a Canton, Ohio, ball-bearing factory. "If they agree that tax relief creates jobs, then why are they for a little bitty tax relief package?"

But the issue is a bit more complicated than that. Most experts agree that, if the Senate gets what it wants, limiting tax cuts to $350 billion, the less-controversial cuts would be the most likely parts of the plan to pass. Those include an acceleration of tax-rate cuts scheduled for 2004 and 2006, the reduction of the so-called "marriage penalty" and an increase in child-care credits.

Left out in the cold, in that case, would be the president's plan to eliminate most individual taxes on dividends. Bush and his supporters say cutting or eliminating these taxes would provide an immediate boost to the stock market, which would only help the economy.

Ultimi Articoli

Strapazzami di coccole Topo Gigio il Musical: una fiaba che parla al cuore

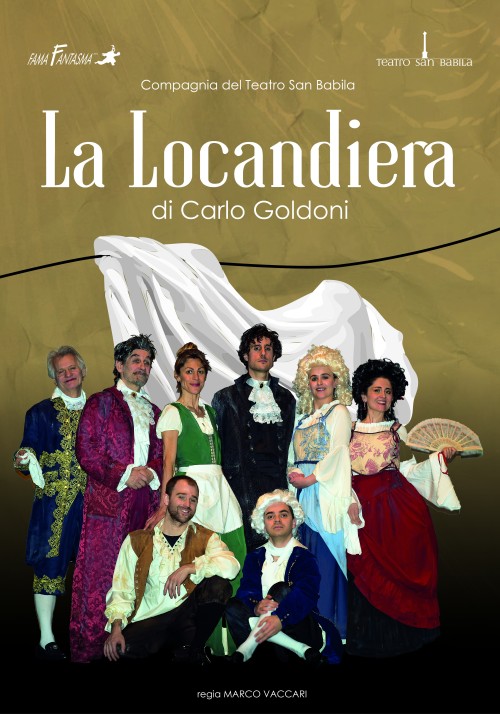

Goldoni al Teatro San Babila di Milano con La Locandiera

Ceresio in Giallo chiude con 637 opere: giallo, thriller e noir dall'Italia all'estero

Milano celebra Leonardo — al Castello Sforzesco tre iniziative speciali per le Olimpiadi 2026

Trasporto ferroviario lombardo: 780.000 corse e 205 milioni di passeggeri nel 2025

Piazza Missori accoglie la Tenda Gialla – Tre giorni di volontariato under zero con i Ministri di Scientology

Neve in pianura tra venerdì 23 e domenica 25 gennaio — cosa è realmente atteso al Nord Italia

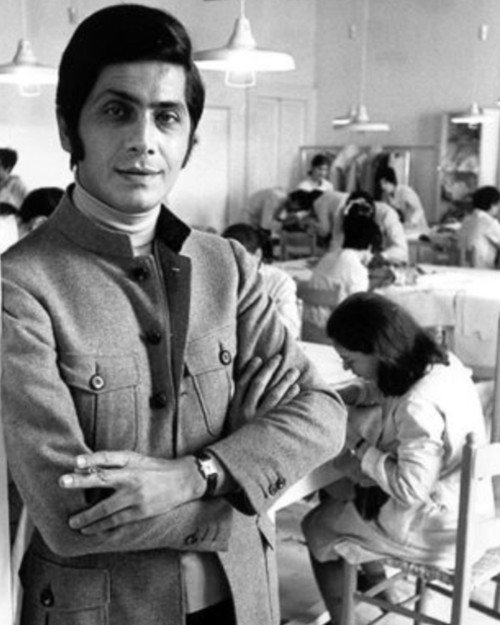

Se ne va Valentino, l'ultimo imperatore della moda mondiale

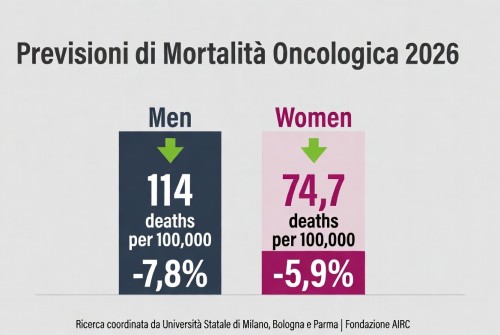

La mortalità per cancro cala in Europa – tassi in diminuzione nel 2026, ma persistono disparità